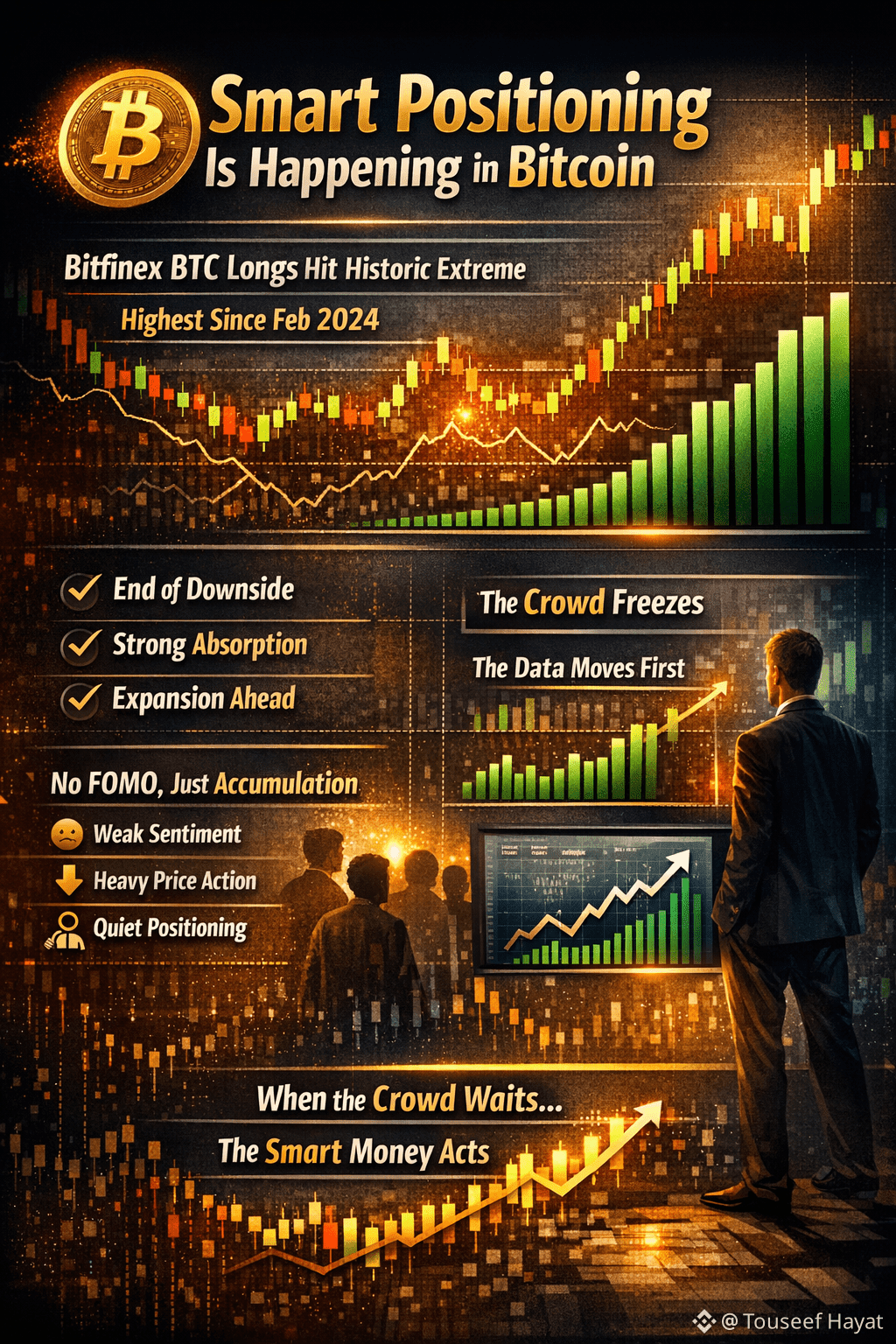

While the broader market remains cautious and sentiment stays weak, something important is happening beneath the surface — smart money is positioning early.

Recent on-chain and derivatives data reveals that Bitcoin longs on Bitfinex have reached a historic extreme, the highest level seen since February 2024. This is not random behavior, and it’s certainly not emotional FOMO.

📊 What the Data Is Telling Us

Historically, whenever Bitfinex $BTC longs spike to such levels, it has marked key structural turning points in the market:

✅ The end of downside pressure

✅ Strong absorption by large players

✅ The beginning of a new expansion phase

This pattern has repeated consistently in past cycles.

Right now, price action looks heavy, momentum feels slow, and the crowd is hesitant. That’s exactly when accumulation happens quietly — not during hype, but during discomfort.

🧠 Why This Isn’t FOMO

Retail FOMO appears when price is already moving fast and headlines turn bullish. What we’re seeing now is the opposite:

Weak sentiment

Sideways-to-heavy price action

Lack of excitement

Yet positioning is increasing, not decreasing.

This is classic smart positioning — building exposure before the move, not chasing it after.

👀 The Crowd Freezes — The Data Moves First

Most traders freeze during these phases, waiting for confirmation. Institutions don’t. They rely on data, structure, and probability — and that data is already shifting.

Bitcoin doesn’t announce its next expansion loudly.

It builds it silently.

Those watching only price may miss it.

Those watching positioning already see it.

#ZTCBinanceTGE #BinanceHODLerBREV #WriteToEarnUpgrade #CPIWatch