whales scooping up coins like they're on sale at a Black Friday blowout, while retail traders are hitting the panic button and selling everything.

Whales are those big fish large holders or institutions with deep pockets, often controlling thousands of BTC or equivalent in alts like ETH or XRP. Retail traders? That's most of us: everyday folks reacting to price charts, news headlines, and that gut-wrenching fear when the market dips 10-20% in a day.

1. Whales Play the Long Game, Retail Chases the Short-Term High

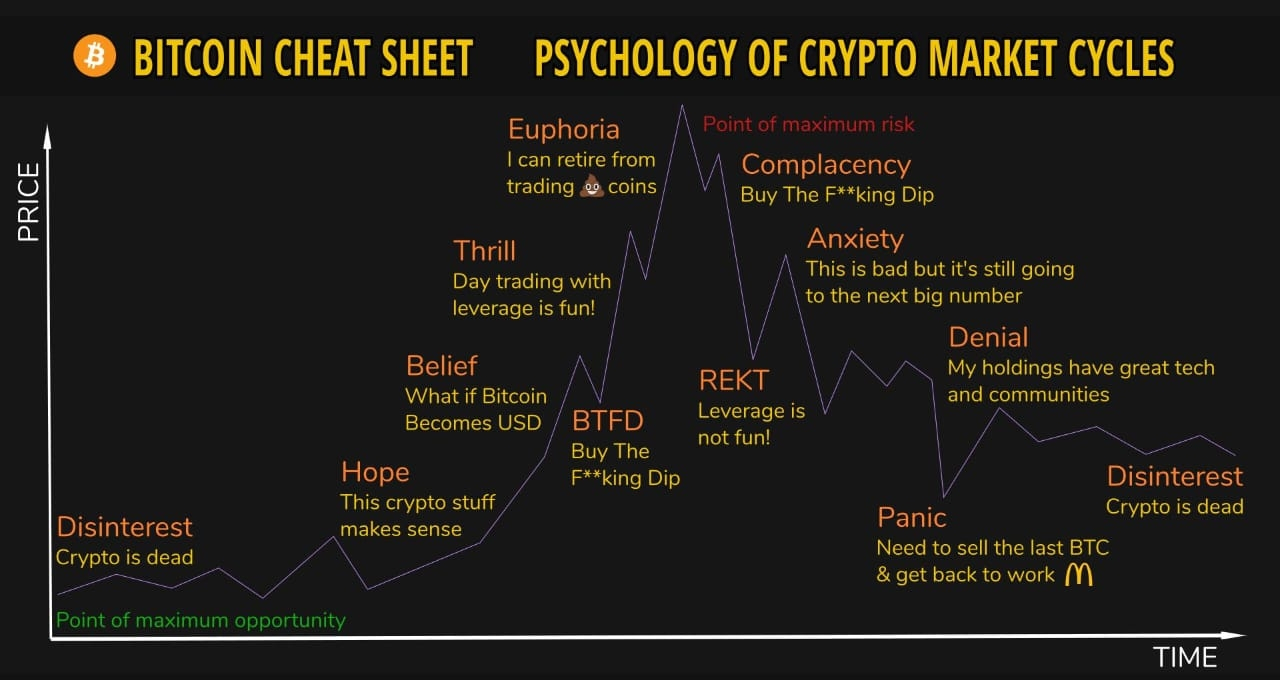

From what I've observed, whales aren't swayed by daily volatility. They have access to sophisticated tools, on-chain analytics, and sometimes insider-ish insights (without crossing lines, of course). When the market crashes like the recent $311B wipeout in early February 2026 retail panics and sells to cut losses. Whales? They see opportunity. Data shows large holders absorbed massive supply during that dip, with Bitcoin whale wallets jumping from 1,207 to 1,303 entities holding 1,000+ BTC. It's like they're betting on the recovery, knowing crypto cycles are predictable: fear leads to capitulation, which leads to accumulation, then boom new highs.

Warren Buffett's old adage "be fearful when others are greedy, and greedy when others are fearful" applies here perfectly. Whales embody that; retail often does the opposite, buying at peaks driven by FOMO and selling at bottoms out of FUD.

2. It's a Wealth Transfer Mechanism Designed That Way

Markets are psychological battlegrounds. Whales can influence prices through large trades, creating cascades of liquidations that force leveraged retail positions to close. One post nailed it: "Every red candle is designed to transfer coins from the impatient to the powerful."

On-chain metrics back this up during recent sell-offs, whales accumulated $5.3B in Bitcoin while smaller wallets dumped.

Exchange balances drop, long-term holder wallets grow.

From my data-driven lens, this isn't conspiracy; it's game theory. Whales can afford to wait out the storm because they don't need liquidity tomorrow. Retail? Bills to pay, emotions running high,easy to shake out. Historical patterns show this precedes rallies, like when ETH whales accumulated 620K tokens in 2024, leading to a 66% surge.

3. Better Timing and Risk Management

Whales usead vanced strategies,time-weighted buying, arbitrage across derivatives, and absorbing supply when bids vanish.

They're not panic-buying; they're stabilizing inventory while leverage resets. Retail often gets caught in analysis paralysis or blames external factors, but whales move in unison to create liquidity traps. I see this in code-like patterns: (market fear) → process (whale accumulation) → output (price recovery). It's efficient, if a bit ruthless. If you're retail, the lesson is patience,buy heavy on pullbacks, don't get fooled by short-term noise.

Final Thoughts: Don't Be the Panic Seller

In the end, whales accumulate during fear because they know the game's rigged in favor of those who can hold through the noise. Crypto's volatile, but data screams bullish when big players stack sats quietly.

If you're reading this, consider this your nudge: zoom out, study on-chain signals, and think like a whale. The next leg up might be closer than the charts suggest.What do you think? Are you accumulating or watching from the sidelines? Drop your thoughts below,let's discuss!