It’s hard to ignore that the market is clearly favoring Gold over Bitcoin right now.

You don’t even need complex indicators to see it, the difference shows up plainly in price action, momentum, and where capital is moving.

From my own experience watching markets through multiple cycles, this kind of divergence usually says more about investor psychology than about the assets themselves.

Where Prices Stand Right Now

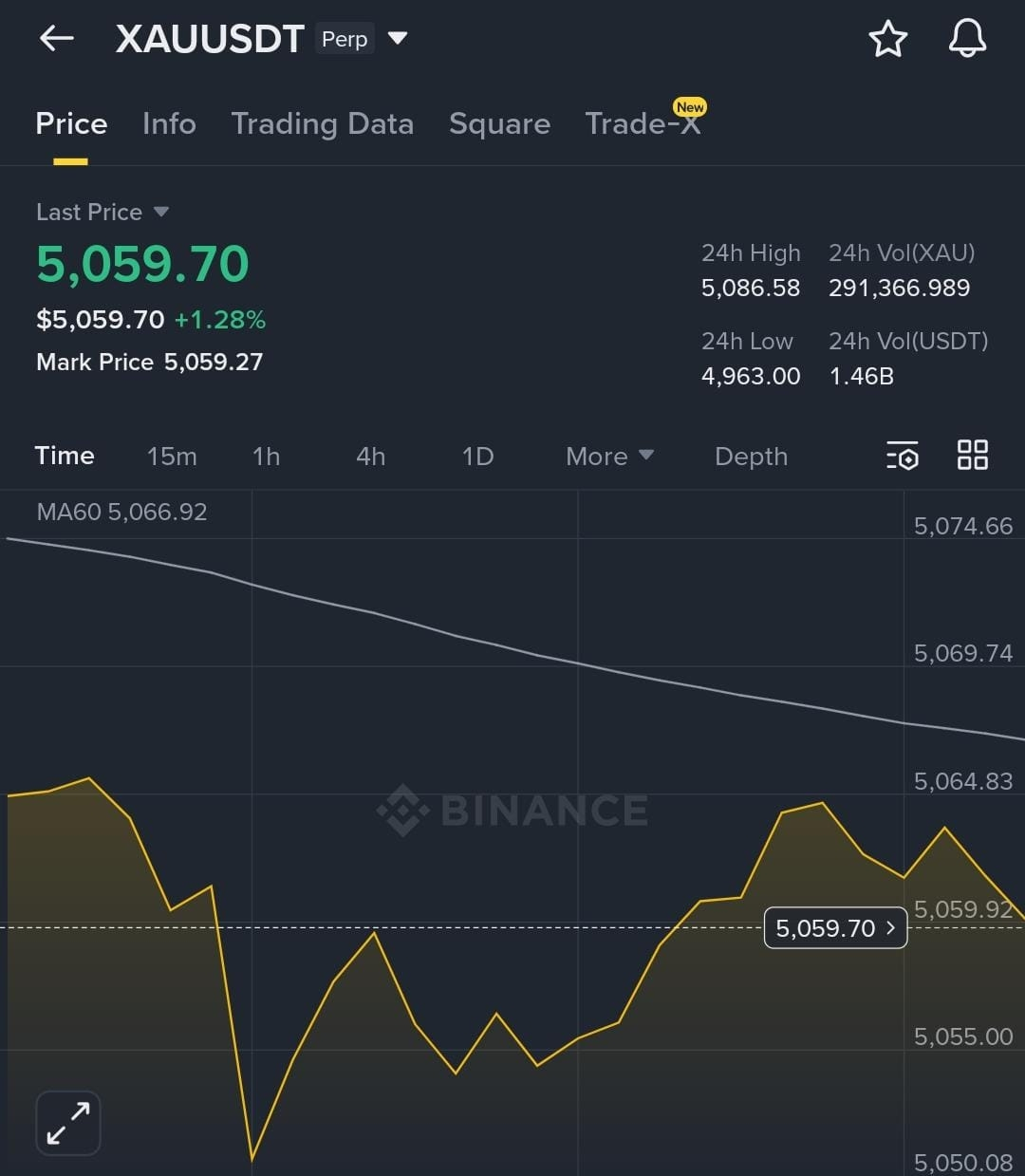

Gold is trading firmly around $5,000–$5,060 per ounce, with recent spot highs pushing into the $5,070+ area. I’ve noticed that pullbacks in gold are getting bought almost immediately, which is classic behavior when institutions are quietly accumulating rather than trading for short-term gains.

XAU.

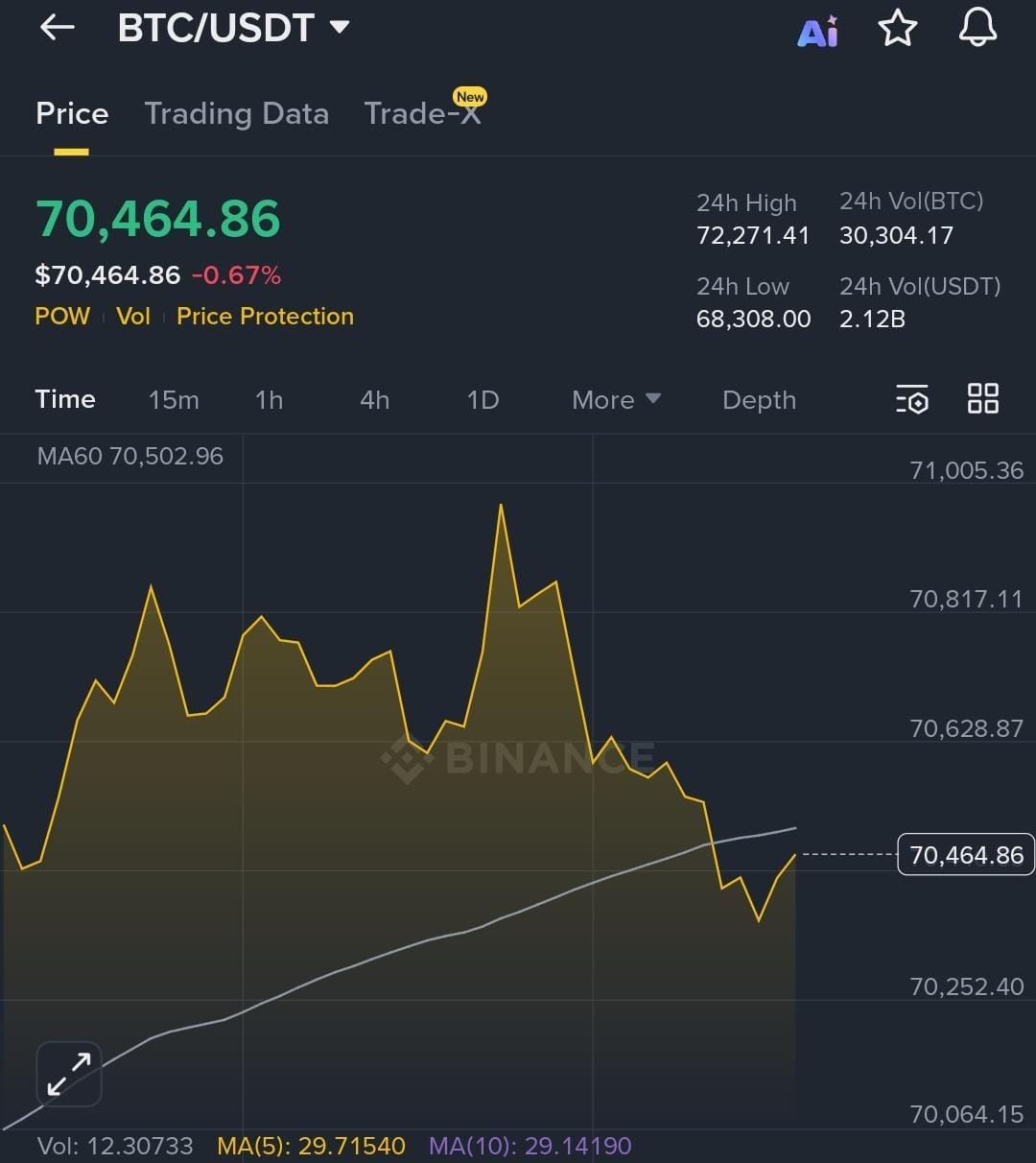

Bitcoin, meanwhile, is stuck around $69,000–$71,000.

It’s not collapsing, but it’s not inspiring confidence either. I’ve seen this kind of price action before; tight ranges, low conviction moves, and lots of traders waiting for a macro trigger. It feels more like hesitation than strength.

BTC

Recent Performance: A familiar pattern

Gold has been the clear winner. Gains of 65–75% over the past year aren’t just impressive, they reflect strong, persistent demand. In my view, this looks less like speculation and more like capital seeking safety in a world that feels increasingly unstable.

Bitcoin story is different. Despite earlier highs near $126,000, it’s now down roughly 40–50% from the peak. What stands out to me is that during recent risk-off moments, Bitcoin didn’t behave like “digital gold.” Instead, it traded more like a leveraged tech asset, something I’ve personally seen happen in past tightening cycles.

What the Bitcoin-to-Gold ratio is signaling

The Bitcoin-to-gold ratio has dropped to around 13.6–14.2, and that matters more than most people realize. I’ve found this ratio to be one of the cleanest ways to see where real strength is. Right now, it’s saying gold is in control.

Even more telling is the negative correlation that’s developed over the past year. This “decoupling” reminds me of earlier periods when gold moved first and Bitcoin lagged until liquidity returned. It’s not necessarily bearish long term, but it is a warning sign in the short to medium term.

Why Gold Is winning the capital rotation

Given geopolitical tension, ballooning government debt, and steady central-bank buying, the shift toward gold feels logical. I’ve seen this play out before; when uncertainty rises, investors don’t experiment, they go with what has worked for decades.

Bitcoin, for all its innovation, still hasn’t fully earned trust as a crisis hedge. Every time we enter a risk-off phase, it seems to get judged more harshly. That’s something long-term holders need to be honest about.

Could Bitcoin Have Its Moment Later?

I still think Bitcoin’s long-term case is intact. Fixed supply, institutional ETFs, and asymmetric upside are powerful ingredients. Historically, gold often leads these cycles, and Bitcoin follows once conditions ease. I’ve personally seen BTC “wake up” months after gold has already made its move.

Prediction markets giving Bitcoin a 40–50% chance of outperforming gold in 2026 feel reasonable to me, not guaranteed, but plausible if liquidity improves or policy shifts.

My Takeaway

Right now, the market is speaking clearly: gold is the asset for protection and momentum, while Bitcoin is in a pause, waiting for the next macro catalyst.

Personally, I don’t see this as an either-or decision. Holding gold for stability and Bitcoin for asymmetric upside has worked well for me in past uncertain periods.

With their correlation turning negative again, a barbell approach feels less like a theory and more like common sense.