Prediction markets are not inherently gambling tools. Their function depends on user intent. The same YES or NO contract can represent speculation, insurance style hedging, or risk free arbitrage.

Hedging is the most misunderstood but most powerful use case. When users already carry exposure such as airdrops, leveraged positions, or price risk, prediction markets allow that risk to be priced, transferred, and partially neutralized.

Arbitrage activity is essential to market quality. By exploiting temporary price inconsistencies across outcomes or platforms, arbitrageurs improve efficiency and turn prediction markets into reliable probability and pricing signals.

Are prediction markets just casinos?

At first glance, they do look like one. Users buy YES or NO on whether an event will happen. After the event resolves, positions are settled. If the outcome matches your position, you profit. If not, you lose. This structure feels very similar to traditional gambling.

However, this interpretation only captures one narrow use case.

The core idea of a prediction market is to turn the question “will an event happen” into a tradable market. What is really being traded is probability. Capital becomes a way to express beliefs, manage exposure, and transmit information through prices.

If someone enters a prediction market only to guess outcomes such as weather events or sports results, then the behavior is indeed close to gambling.

But prediction markets can support much broader financial behavior. In many situations, they resemble insurance markets or financial derivatives rather than casinos.

For some participants, prediction markets are entertainment.

For others, they are tools for managing risk or extracting price inefficiencies.

The difference is not the mechanism. It is the motivation for participation.

If you enter without existing exposure and simply want to guess an outcome, you are betting.

If you already face risk linked to an event, the prediction market becomes a place to trade that risk.

THREE DISTINCT WAYS TO USE PREDICTION MARKETS

Prediction markets support very different strategies depending on how users approach risk and profit.

BETTING

In betting mode, the user actively takes on outcome risk.

There is no prior exposure to the event. The user selects a direction based on belief or intuition. If the prediction is correct, the payoff depends on the entry price and implied probability. If incorrect, the position can lose its full value.

Returns can vary widely. They range from small gains to very large multiples, depending on how unlikely the outcome was at entry.

The logic is simple. You predict whether an event will happen.

This is the use case that most closely resembles gambling.

HEDGING

In hedging mode, the user already carries risk.

The goal is not to maximize upside. The goal is to reduce downside. This behavior is closer to buying insurance.

The user places a position on an outcome they do not want to happen. If that outcome occurs, the profit from the prediction market helps offset losses elsewhere.

The key idea is risk transfer. The user pays a premium to reduce uncertainty.

ARBITRAGE

In arbitrage mode, the user avoids outcome risk altogether.

Profit comes from price inconsistency rather than predicting results. Individual trades usually have very small margins. Profit depends on repetition and execution speed.

Arbitrage activity helps align prices across markets and improves overall efficiency.

The core logic is straightforward. When prices do not match, arbitrage closes the gap.

HEDGING AIRDROP VALUATION RISK WITH PREDICTION MARKETS

In crypto markets, airdrops are common and often uncertain.

Two questions appear almost every time.

What will the valuation be at launch, and was the participation effort worth it.

After receiving the tokens, should they be sold immediately, or is there upside or downside risk ahead.

Once you participate in an airdrop, you already hold price exposure. This is different from pure speculation. Prediction markets allow you to manage or transfer that exposure.

This behavior is closer to insurance than betting.

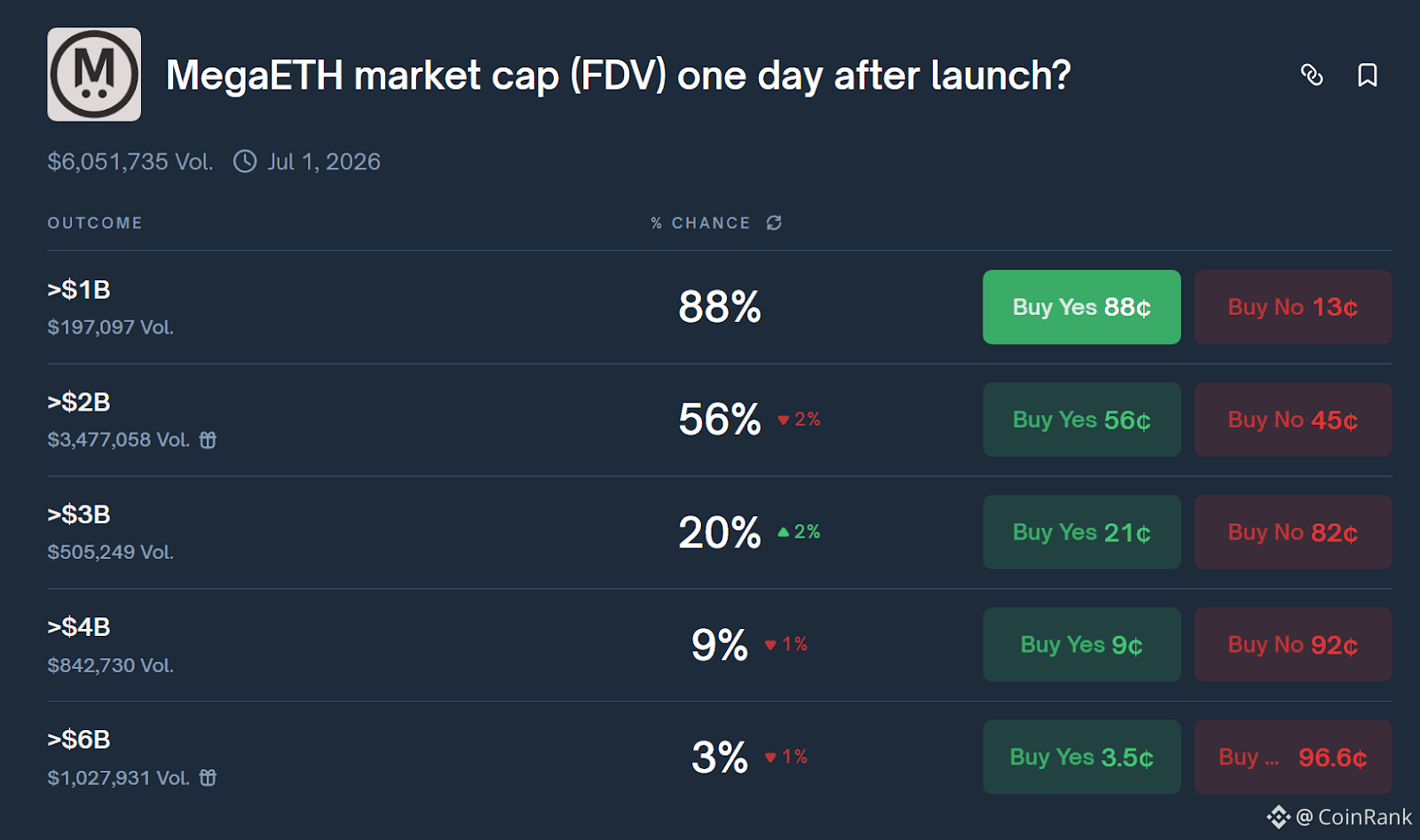

On platforms such as Polymarket, there are markets that predict a token’s fully diluted valuation one day after its token generation event.

Two points are important.

First, this is not the opening price. It is the valuation after one day of trading.

Second, fully diluted valuation is not the same as circulating market cap. It reflects total token supply.

For an airdrop participant, the logic is simple.

If the valuation is high, the token price is high, and the airdrop value is strong.

If the valuation is low, the token price is low, and the airdrop value is weak.

This market can be treated as a hedging tool.

One approach is to buy NO on a high valuation outcome. If the token launches strongly, the airdrop performs well while the hedge loses slightly. If the launch is weak, the airdrop underperforms but the hedge compensates.

Another approach is to buy YES on a low valuation outcome. The structure is the same, with different pricing and payout profiles.

The purpose is not to increase expected returns. It is to reduce variance.

The same logic applies after receiving the tokens.

If you sell immediately but worry about a price surge, you can hedge with positions that benefit from higher valuations.

If you hold and worry about a price drop, you can hedge with positions that benefit from lower valuations.

Prediction market positions can be exited before settlement, subject to liquidity. Position sizing matters. If the hedge exceeds the underlying exposure, the strategy turns back into speculation.

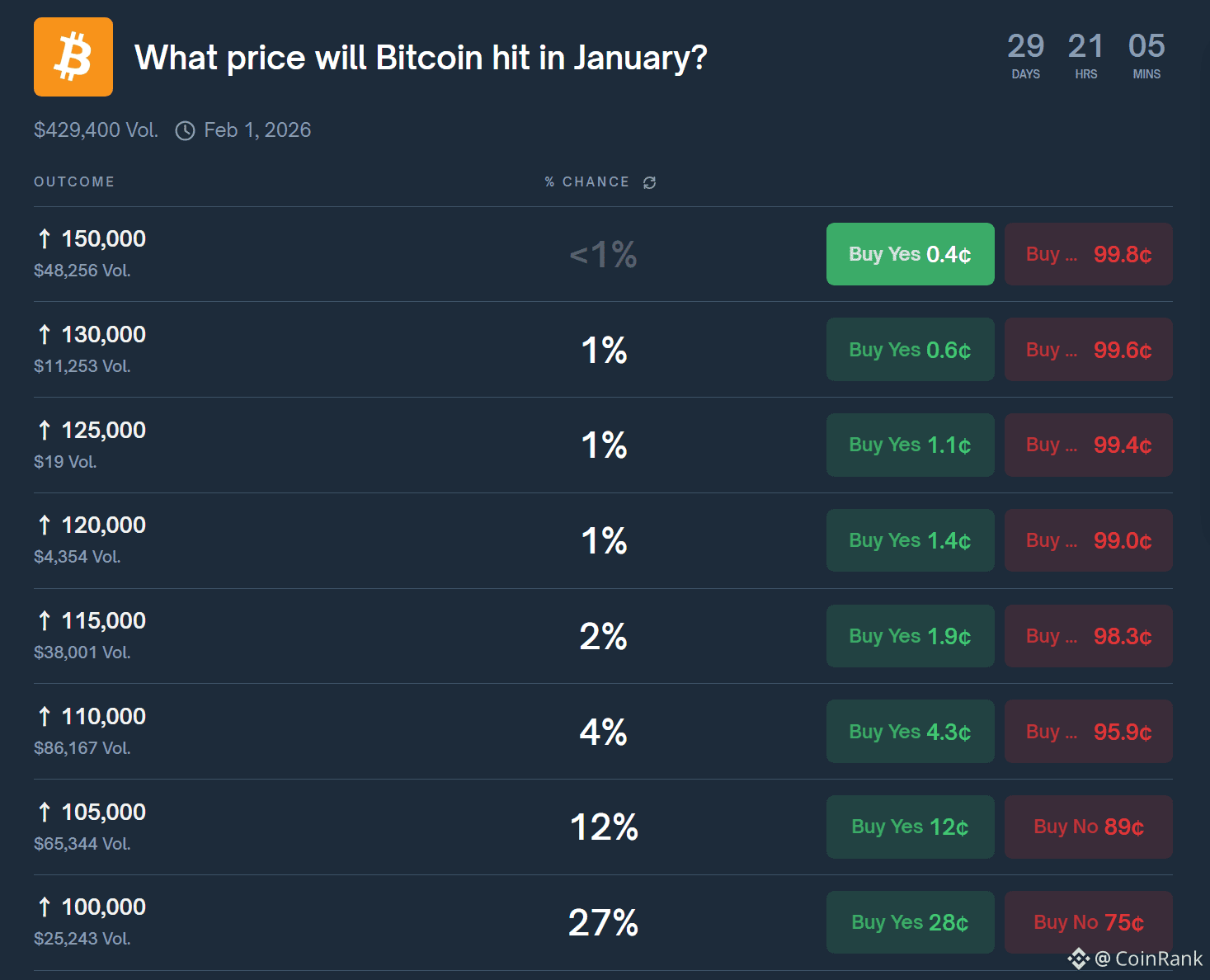

APPLYING THE SAME LOGIC TO BITCOIN AND ETHEREUM RISK

The same principles apply to major crypto assets.

If a trader holds a leveraged position, the most dangerous risk is not short term volatility. It is liquidation during extreme moves.

Prediction markets often offer contracts tied to future price ranges or maximum prices within a time window.

A trader with a short position can use a small prediction market position as protection against extreme upside moves.

The objective is not higher profit. It is survival.

This is risk management, not betting.

ARBITRAGE AND MARKET PRICE ALIGNMENT

Arbitrage is not exploiting errors. It is a natural mechanism that keeps markets coherent.

Arbitrage and hedging share one trait. Neither depends on guessing the final outcome.

They differ in purpose. Hedging manages exposure. Arbitrage manages mispricing.

Because markets are never perfectly aligned, opportunities appear briefly.

SINGLE OUTCOME ARBITRAGE

Each binary outcome has a YES and a NO. Only one settles to one. The other settles to zero.

In theory, buying both for a total cost below one guarantees profit.

In practice, order mechanics prevent placing such trades simultaneously. These opportunities only appear temporarily through timing and liquidity imbalance. They are extremely difficult to execute manually.

MULTI OUTCOME EVENT ARBITRAGE

Some events have multiple mutually exclusive outcomes. Only one can occur.

If the total cost of buying all YES options is below one, arbitrage exists.

This can happen when liquidity is thin or when large trades distort prices. Such opportunities are short lived and often require automation.

CROSS PLATFORM ARBITRAGE

The same event may appear on multiple platforms.

If definitions and deadlines match exactly, positions can be combined across platforms.

Care is critical. Even small differences in definitions or resolution rules invalidate the strategy.

Some events are not identical but logically connected. Mispricing across such events can also create opportunities.

A CLEAR FRAMEWORK FOR USING PREDICTION MARKETS

Betting means you had no prior exposure and chose to take risk.

Hedging means you already had exposure and want to manage it.

Arbitrage means you avoid exposure and exploit price mismatch.

THE LONG TERM ROLE OF PREDICTION MARKETS

Prediction markets are not casinos by default. They are tools for pricing risk.

A useful comparison is CME.

CME is a futures market, but it is also a major pricing center. Participants include banks, asset managers, insurers, and hedge funds. Many trades exist for hedging and balance sheet management rather than speculation.

Prediction markets differ in one key way. They trade probability directly. This makes interpretation more intuitive.

Could they become core onchain pricing infrastructure.

Possibly, but only under certain conditions.

Events must matter economically. Price ranges, macro decisions, protocol launches, and valuation metrics generate real hedging demand. Sports and celebrity gossip do not.

Liquidity must be deep. Without depth, prices carry little informational value.

As onchain finance integrates more macro and financial activity, prediction markets may evolve into essential infrastructure. If that happens, their role in hedging and arbitrage will expand, and their perception as casinos will continue to fade.

〈Prediction Markets Are Not Casinos: Three Ways to Use Them — Betting, Hedging, Arbitrage〉這篇文章最早發佈於《CoinRank》。