A lot of people still think Plasma is just another fast chain. That’s an easy conclusion to jump to, but it misses what Plasma is actually trying to do.

Speed is already cheap. Finality is mostly solved. Even low fees are not rare anymore. The problem Plasma is looking at is much more awkward: stablecoins exist everywhere, yet using them still feels like moving crypto, not money.

That gap is where Plasma lives.

Stablecoins Didn’t Fix Payments, They Just Changed the Wrapper

Stablecoins move trillions, but the way they move is still clunky. Bridges, chain hops, approvals, waiting, fees that change depending on where you are. From a user point of view, it’s all friction.

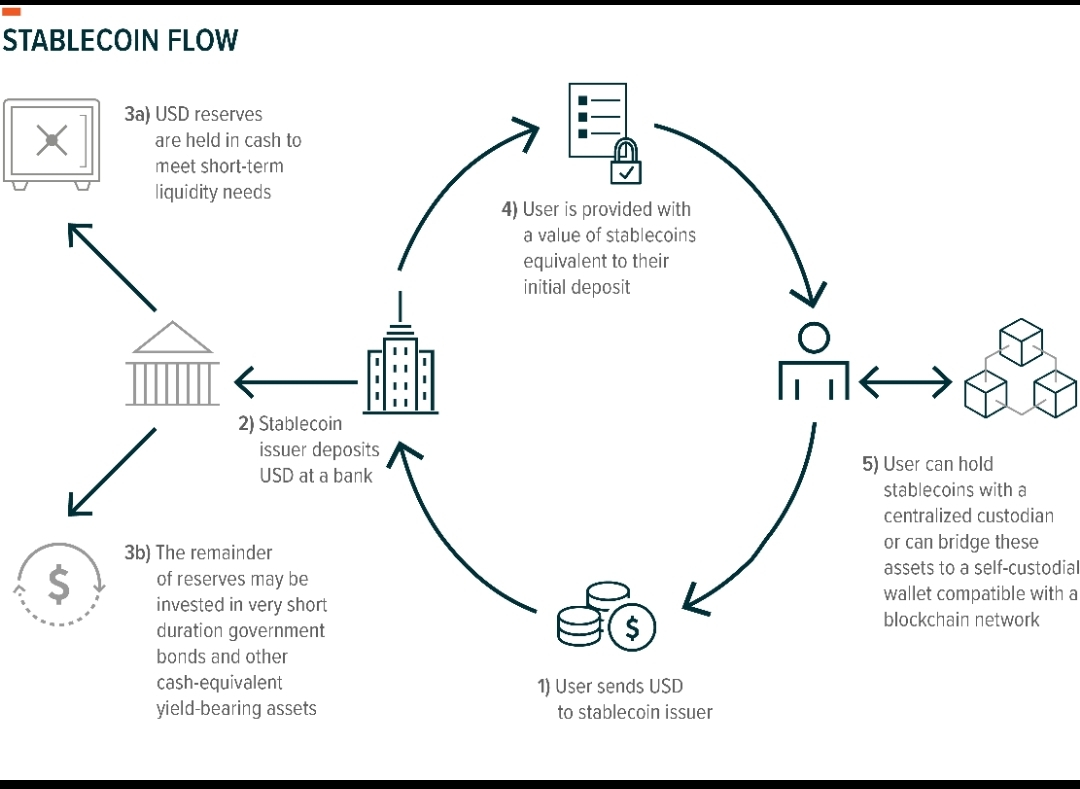

Plasma doesn’t treat stablecoins as tokens to be pushed around. It treats them as balances that should rebalance themselves depending on where they’re needed.

That’s why its work around intent-based liquidity actually matters. Instead of saying “move money from chain A to chain B,” you say “I want to use money here.” The system figures out the rest.

This sounds small. It’s not. It removes an entire layer of mental overhead.

Liquidity Is Not Supposed to Be Trapped

Most chains accidentally trap liquidity. Once funds arrive, everything is optimized to keep them inside. That’s good for TVL dashboards, not for actual money usage.

Plasma is almost doing the opposite. It’s designed so value can flow out as easily as it flows in. That’s uncomfortable for typical crypto thinking, but it’s how real financial systems work.

Money that can’t leave is not useful money.

Payments That Don’t Feel Like a Crypto Demo

Most “crypto payment” products still feel like demos. Convert here, sign there, wait, hope the fee doesn’t spike.

Plasma’s payment integrations are more boring than that, and that’s the point. Merchants don’t need to learn anything new. They don’t need to care what chain the money came from. Settlement just happens in the systems they already use.

Users spend stablecoins without thinking about gas, tokens, or routes. It feels normal. That’s not accidental design, that’s the goal.

Adoption doesn’t come from explaining crypto better. It comes from removing the need to explain it at all.

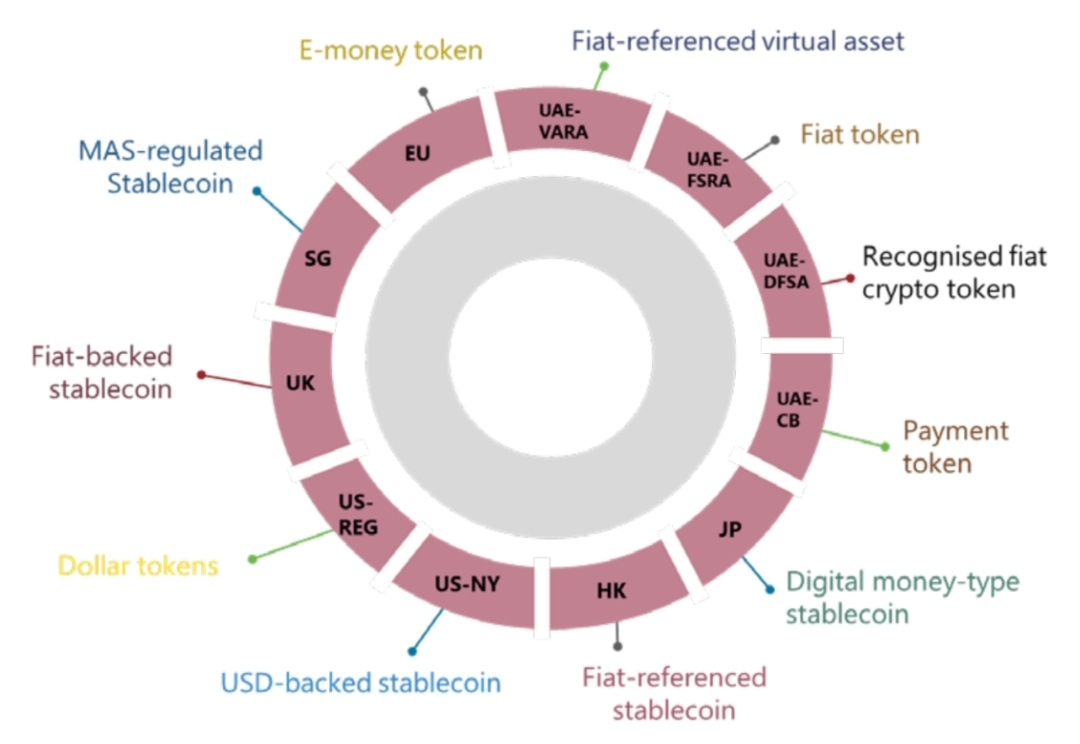

Regulation Is Treated Like Reality, Not an Obstacle

One thing Plasma does that turns off some crypto natives is how openly it works with compliance. But large-scale money doesn’t move in protest of regulation. It moves inside it.

Audit trails, custody rules, regional frameworks — ignoring those doesn’t make a network more free, it just makes it smaller. Plasma is clearly aiming at use cases where banks, institutions, and payment processors are involved.

That’s a strategic decision, not a philosophical one.

XPL Is Meant to Be Stable in Behavior, Not Exciting

Plasma has been pretty direct about XPL not being a speculation-first token. Its role is infrastructure: securing the network, aligning validators, keeping things predictable.

That might sound underwhelming if you’re used to hype cycles. But monetary infrastructure that jumps around in value tends to break trust fast.

If stablecoins are supposed to feel like cash, the system underneath them can’t behave like a casino.

Plasma Isn’t Competing With Most Layer 1s

It’s worth saying clearly: Plasma isn’t trying to win the same game as app-heavy chains or meme-driven ecosystems.

It’s competing with:

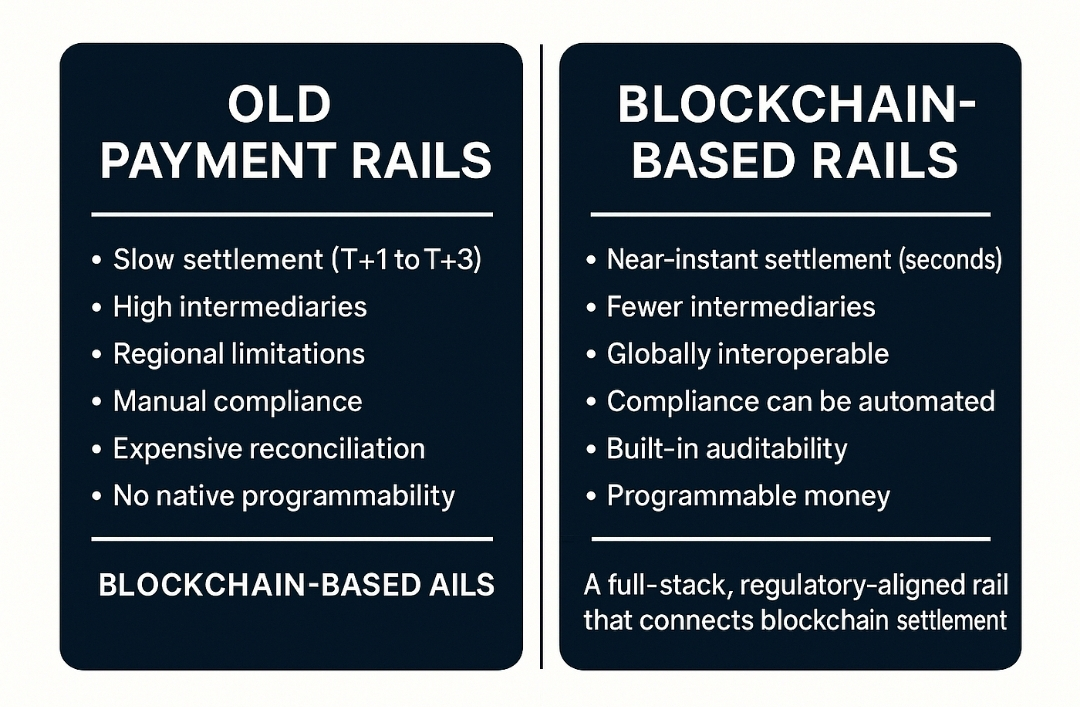

Fragmented settlement systems

Slow cross-border payment rails

Complex stablecoin routing stacks

That’s a very different arena, and it explains why Plasma doesn’t look loud on social timelines.

Where This Direction Likely Ends Up

If Plasma works the way it’s intended, people won’t talk about it much. They’ll just notice that moving stable value feels easier, faster, and less stressful than it used to.

And that’s usually how financial infrastructure succeeds.

Not by being noticed — but by being relied on.