Today’s sharp sell-off in the crypto market was a textbook case where cascading forced liquidations, rather than news itself, drove prices lower. Multiple liquidation waves hit within a short time, pushing Bitcoin through thin liquidity zones and below $79,000. Around $1.3 billion in liquidations occurred over the past 12 hours—not because investors suddenly chose to sell, but because leverage was forcibly unwound.

Liquidation occurs when leveraged positions are automatically closed by exchanges after margin requirements are breached. The key risk is that liquidations execute as market orders, accelerating price declines. Once triggered, liquidations can become self-reinforcing.

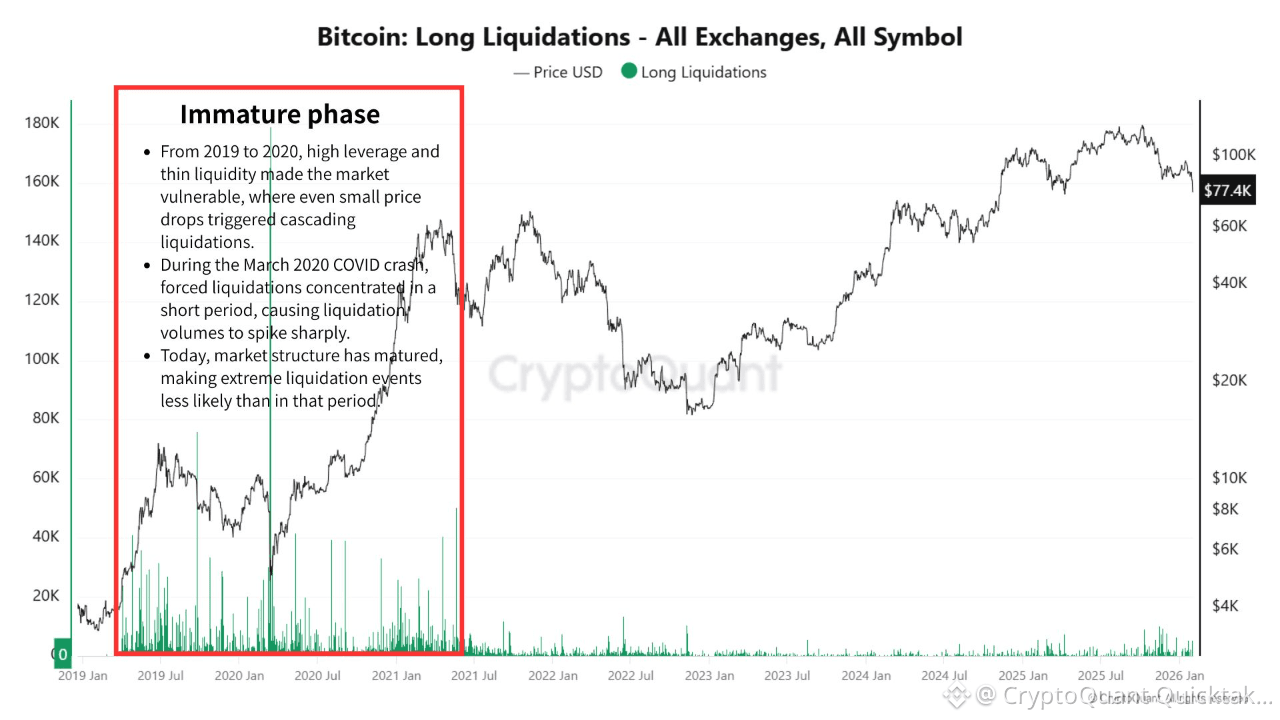

As CryptoQuant charts show, during 2019–2020 the derivatives market was immature, with high leverage and thin liquidity. Even small declines caused cascading long liquidations, culminating in the March 2020 COVID crash where forced selling amplified the collapse.

Market structure has improved, but liquidation risk persists. Major events included May 19, 2021 ($8.5–10B), June 18, 2022 ($6–8B), September 22, 2025 ($3.62B), and October 10–11, 2025—when headline liquidations reached a record $19.3B. On-chain data, however, shows actual BTC and ETH losses were about $2.31B, indicating leverage unwind rather than real economic loss.

Today’s drop followed the same pattern: headlines were merely triggers; the core drivers were flow and liquidity. For retail investors, the greatest risk is not being wrong on direction, but being forced out. Survival depends on designing positions to endure—focusing not on how far prices can rise, but how much downside can be tolerated.

Written by XWIN Research Japan