They're evolving into super-apps, replacing banks: payments, savings, trading — all in one place. The race is on: Coinbase, TrustWallet (Binance), and MetaMask are in!

In an interview, Coinbase CEO:

“We want to be a bank replacement for people, we want to be their primary financial account.”

“We want to be a super app and provide all types of financial services, not only crypto.”

They've already launched a credit card with 4% cashback in BTC — a step toward full banking services.

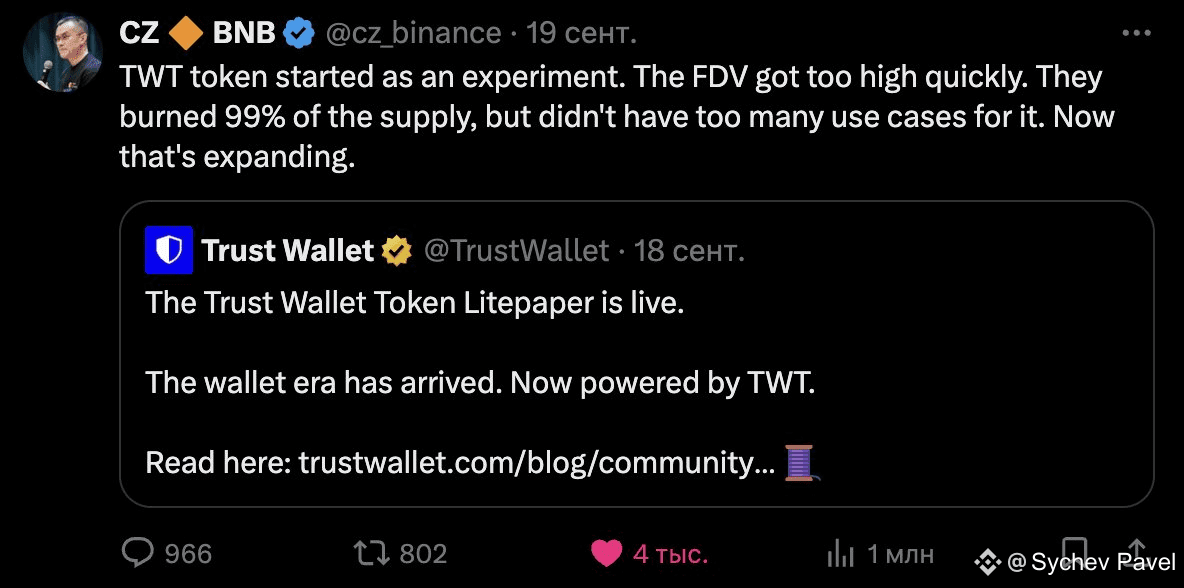

Trust Wallet (from Binance) in their “Next Era” roadmap: the future of finance starts in the wallet, not the bank.

TWT as “fuel” for access, features, and growth to 1 billion users by 2030.

New features: premium (sponsored gas, trading with up to 100x leverage, AI analytics), gas-less transactions, cross-chain, Trust Card/Pay for spending, staking, lending, airdrops, and accelerator for Web3 projects.

MetaMask launched the stablecoin mUSD — wallet-native, 1:1 with USD, integrated into swaps, bridging, fiat on-ramps.

You can spend it via MetaMask Card in millions of places. Confirmed token $MASK (launch soon): governance, rewards, perpetual trading via Hyperliquid, asset management right in the wallet.

Conclusion: A new era for Web3 wallets — from mere storage to super-apps competing with banks.

Coinbase aims to be the “primary financial account” with cards and payments. MetaMask with mUSD and MASK adds DeFi conveniences.

But @CZ (Binance) won't back down: Trust Wallet is their strategic entry into the US market, where Binance faces regulatory limits.

This is direct competition for mass users through simple UX, fiat ramps, security, and partnerships (Mastercard, mobile integrations). We'll see who captures billions!