Key Takeaways

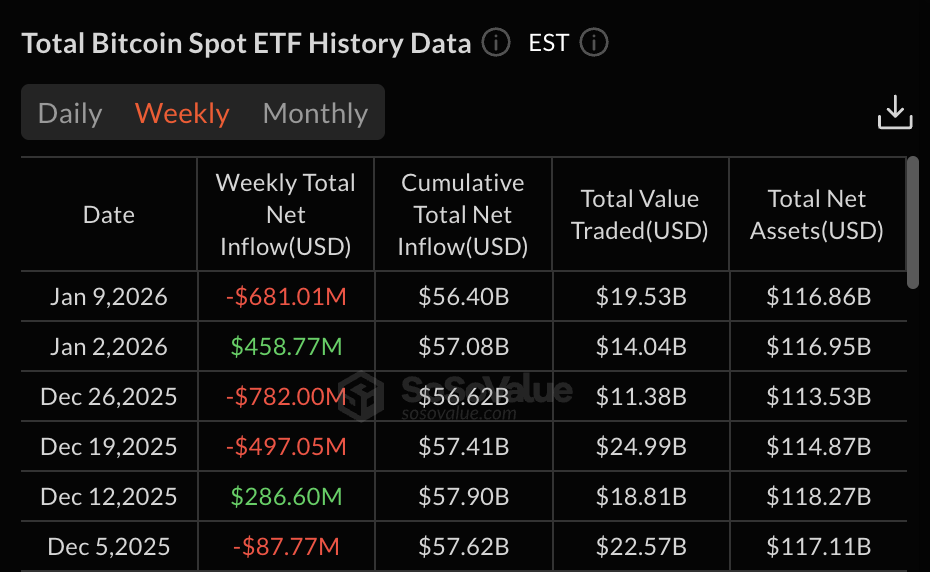

Bitcoin ETF outflows total $681 million in the first full week of 2026

Spot Ether ETFs see $68.6 million weekly net redemptions

Macro uncertainty and delayed rate-cut expectations drive risk-off positioning

Spot Bitcoin ETFs See Four Days of Redemptions

Spot Bitcoin ETFs recorded four consecutive days of net outflows from Tuesday to Friday, according to SoSoValue data. The largest single-day withdrawal hit $486 million on Wednesday, followed by $398.9 million on Thursday and $249.9 million on Friday.

These redemptions erased earlier gains, after ETFs attracted $471.1 million on Jan. 2 and $697.2 million on Jan. 5. The reversal marked a sharp shift in near-term Bitcoin ETF flows.

Ether ETFs Mirror Bitcoin Weakness

Spot Ether ETFs followed a similar path, posting approximately $68.6 million in weekly net outflows. Total net assets across Ether products stood near $18.7 billion at week’s end.

The parallel decline suggests broader caution across digital asset ETFs, not isolated Bitcoin news. Correlated flows reflect shared exposure to macro-driven risk sentiment.

Macro Uncertainty Drives Risk-Off Positioning

Analysts have attributed the pullback to shifting expectations around monetary policy. Investors are also closely watching Federal Reserve guidance and upcoming U.S. CPI data. Until clearer signals emerge, buying pressure may remain limited.

Institutional Interest Remains Intact Despite Outflows

Despite short-term ETF weakness, broader institutional interest continues to build. Morgan Stanley filed with the SEC to launch spot Bitcoin and Solana ETFs, becoming the first major U.S. bank to pursue such products.

Meanwhile, Bank of America authorized advisers to recommend select Bitcoin ETFs to clients. These moves signal long-term confidence in blockchain-based investment products, even amid volatility.

Bitcoin Outlook: Tactical Shift, Not Structural Exit

While weekly outflows reached $952 million, month-to-date ETF flows remained positive at $588 million in late December. In 2025, crypto ETPs attracted $46.7 billion, underscoring durable demand.

The current pullback appears to reflect tactical repositioning rather than a loss of conviction. For now, the Bitcoin outlook hinges on macroeconomic data, policy clarity, and whether renewed bullish momentum can return to ETF flows.