Dusk is rarely discussed as an investment asset in the correct context.

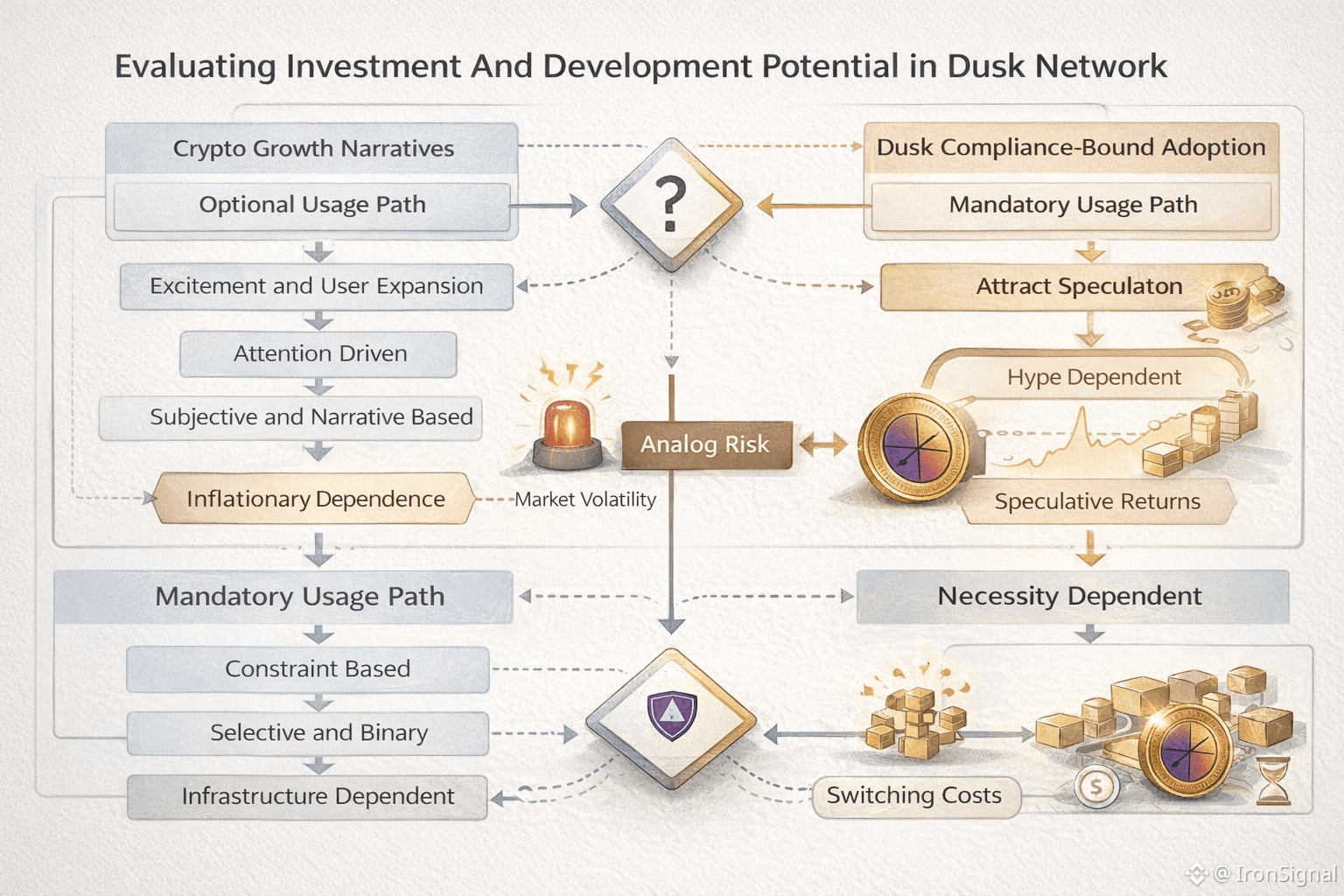

Most analysis tries to position it inside familiar crypto narratives, growth, adoption, user expansion. That framing immediately creates confusion, because Dusk was never designed to optimize for those variables.

The investment potential of Dusk is not driven by expansion. It is driven by constraint.

Dusk Network exists to solve a specific problem that most blockchains actively avoid. How to support financial workflows that must remain confidential while still being verifiable under regulation. This problem does not scale through hype. It scales through necessity.

From a development perspective, this immediately narrows the addressable market. Dusk is not competing for retail users, speculative applications, or experimental DeFi. It is positioning itself as infrastructure for regulated financial activity. That choice reduces visible adoption, but it dramatically increases the quality of potential dependency.

This is where the investment logic diverges from most crypto assets.

Projects built around optional usage must constantly attract attention to survive. Their value depends on continuous inflow. Dusk is built around mandatory usage under specific conditions. When confidentiality and selective disclosure become requirements rather than preferences, the system either works or it does not. There is no substitute.

That creates a binary development outcome.

Either Dusk succeeds in supporting regulated workflows, or it fails entirely. There is little middle ground. This is risky, but it is also where asymmetric value emerges.

The protocol design reflects this positioning. Confidentiality is enforced at the base layer, not delegated to applications. Validity is provable without public visibility. Disclosure is selective and rule based. These are not features added for convenience. They are structural decisions aligned with compliance reality.

This architecture limits short term ecosystem growth. Many crypto use cases simply do not fit. However, it strengthens long term survivability. Systems that depend on Dusk do so because alternatives cannot meet the same constraints.

The DUSK token reflects this design philosophy.

With a fixed total supply and no incentives tied to visible activity, DUSK does not reward artificial engagement. Its role is to coordinate participation in a network where correctness and confidentiality matter more than volume. This makes the token unattractive during speculative expansions, but structurally aligned with long term dependency.

From an investment perspective, this creates a different risk profile.

Dusk carries high perception risk. Progress is difficult to observe. On chain metrics are muted. Market narratives rarely form. This leads to persistent mispricing during attention driven cycles.

At the same time, it carries lower structural risk once adoption occurs. Infrastructure integrated into regulated workflows is not easily replaced. Switching costs are high, and failure is expensive. This is not a market that churns quickly.

The development trajectory of Dusk should therefore be evaluated differently.

The key question is not how fast it grows, but whether it continues to align with regulatory requirements as they harden. If it does, adoption becomes a function of time and external pressure, not marketing.

This is why Dusk often appears early and late at the same time.

Early in solving the problem.

Late in being recognized by the market.

For investors, this means Dusk is not a momentum asset. It is a conditional asset. Value emerges when conditions shift in its favor, not when narratives rotate.

Dusk Network is not built to outperform in every cycle. It is built to remain viable when cycles end.

That makes its investment potential difficult to model, but also difficult to ignore for those who understand what regulated financial infrastructure actually requires.