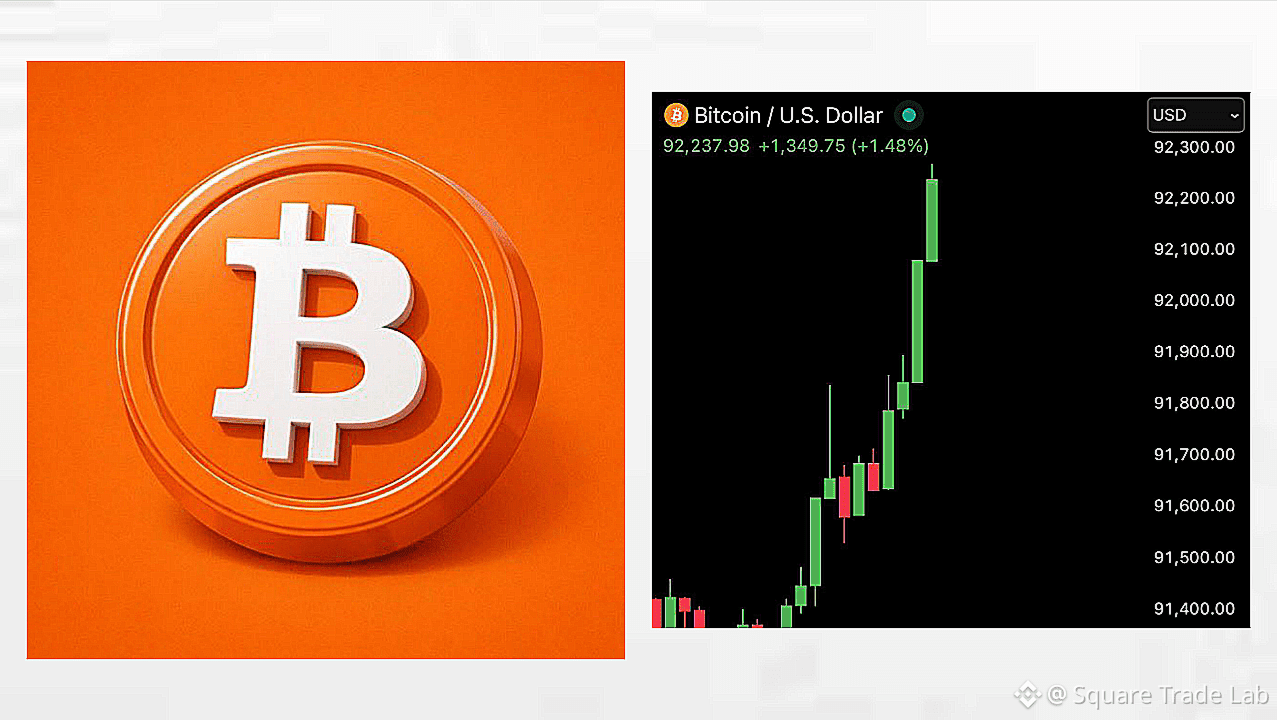

🚨 BREAKING: BITCOIN RECLAIMS $92,000 — MARKET SENTIMENT TURNING EXTREMELY BULLISH 💥

Bitcoin ($BTC) has surged back above $92,000, reclaiming a pivotal technical and psychological level that traders and analysts have been monitoring for weeks. This marks a critical moment for BTC, signaling the end of short-term consolidation and the potential start of a strong upward trend in both price and market confidence.

🔹 TECHNICAL ANALYSIS

Key Resistance Turned Support:

The $92,000 level has historically acted as both resistance and support. Reclaiming it is a signal that buyers are back in control.

Potential Price Targets:

If BTC sustains above $92K, short-term targets include $95,000–$98,000, with the possibility of revisiting the $100,000 zone if institutional momentum continues.

Volume Confirmation:

Recent volume spikes indicate significant buying pressure, confirming that this move is not a temporary wick but a genuine market shift.

Support Zones:

$90,500–$91,000 now acts as strong support, limiting downside risk in the near term.

🔹 MARKET PSYCHOLOGY

Retail Confidence Rising:

Traders who have been on the sidelines may now enter long positions, adding fuel to BTC's rally.

FOMO Effects:

Fear of missing out could trigger additional buying waves, especially if BTC closes above $92K on daily charts.

Sentiment Indicators:

Crypto fear/greed indexes have shifted from “neutral” to “greed”, reflecting heightened bullish sentiment across the market.

🔹 ON-CHAIN METRICS

Whale Activity:

Large BTC holders have been accumulating heavily, reducing sell-side pressure and creating scarcity.

Exchange Flows:

Net outflows from major exchanges indicate BTC is moving to long-term storage wallets, a bullish sign that coins are being hoarded rather than sold.

Transaction Volume:

Daily transaction volumes have spiked above 350,000 BTC, the highest level since the last major bull rally.

🔹 INSTITUTIONAL AND MACRO CONTEXT

Institutional Buying:

Recent filings show institutions are buying BTC at multi-month lows, increasing long-term confidence in the asset.

ETF and Regulatory Developments:

Bitcoin ETFs and crypto-friendly legislation are removing barriers to large-scale investment, providing structural support.

Macro Conditions:

Global liquidity remains high, encouraging capital flows into Bitcoin as a store of value.

USD weakness and inflation concerns are driving investors to hedge with BTC.

Central banks are taking note of Bitcoin as a reserve-like asset, supporting adoption.

🔹 SHORT-TERM AND MID-TERM OUTLOOK

Short-Term:

BTC is likely to test $95K–$98K if momentum continues and support holds.

Mid-Term:

Sustained accumulation by whales and institutional players could propel BTC toward $105K–$110K by the end of Q1 2026.

Risk Factors:

Failure to hold $92K could trigger a minor pullback to $88K–$90K.

Macro shocks or regulatory shifts could temporarily slow momentum.

🔹 SUMMARY

Bitcoin reclaiming $92,000 is a pivotal bullish moment. Multiple factors converge to create a perfect storm for potential upside:

Technical confirmation and key level reclamation

Whale accumulation reducing sell pressure

Institutional inflows providing structural support

Strong retail and market sentiment

Macroeconomic conditions favoring BTC adoption

This move positions BTC as the centerpiece of the crypto market heading into the new year, with Ethereum, XRP, and other major coins likely to follow the trend.

🚀 CONCLUSION

Investors and traders should watch the $92K–$95K zone closely. Sustained buying here signals a potential accelerated rally toward $100K and beyond. Market participants must also monitor institutional flows and whale activity for signs of long-term accumulation.

Bitcoin is leading the crypto market higher, with renewed confidence, liquidity, and macro tailwinds combining to create a high-conviction bullish environment.